Paying property taxes can be a daunting task, but with the options to pay online, by mail, or in-person, there are more ways to tackle taxes than ever before. GreatNews.Life had the opportunity to speak with Porter County Treasurer Michelle Clancy about all the ways you can pay this tax season.

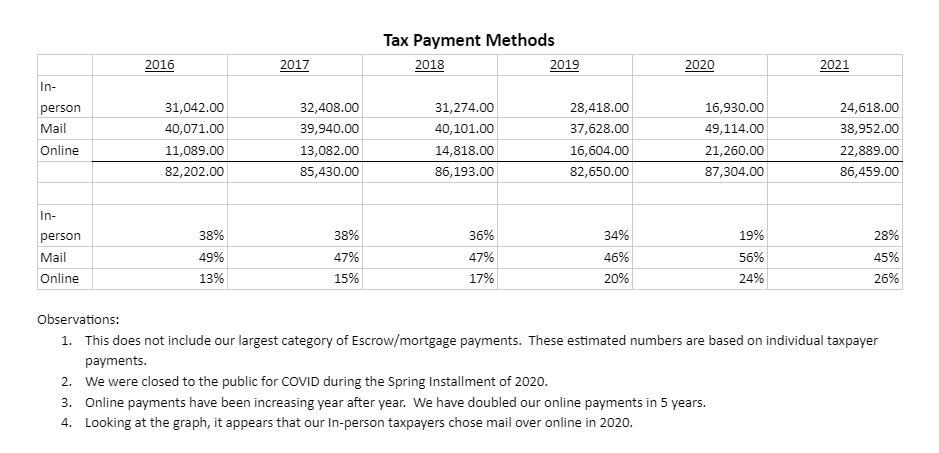

In your experience, what percentage of people pay their taxes online, by mail, or in-person?

How do you pay online?

- Go to our tax website www.lowtaxinfo.com.

- Select Porter County.

- The best way to search is to enter your Duplicate Number from your bill. If you do not have your Duplicate Number, type in the last name, enter space, and then the first name of the Owner of Record.

- Click on the Owner of Record to select that account and open up the details.

- Scroll down a little then click the blue Pay Tax Bill button.

- Add the taxes you want to pay to your shopping cart and follow payment instructions.

What are the benefits of paying online?

- Your online payment gets credited with the time and date you initiated the payment. You can pay up until midnight on the due date.

- You will immediately receive an email confirming that you initiated a payment.

- You do not have to depend on the post office.

- If we receive your mailed payment after the due date and the post office did not postmark your envelope with a date on or before the due date, you will receive penalties.

- You can register for eNotices if you prefer to go paperless, and your bills and payment history will be stored online for your convenience.

What are the benefits of paying in-person?

- You do not have to depend on the post office.

- You have a receipt for your payment.

What do people need to do in preparation for paying taxes online, by mail, or in-person?

- Nothing, we prefer that you have your Duplicate Number but whether paying online or in-person, your account can be paid by searching with basic information.

Do you have any tips on paying taxes?

- Please take your time when entering your payment information. If the data is entered wrong, we will not be notified until your bank rejects the payment. If your payment is rejected after the deadline, penalties will apply.

- Many non-escrow taxpayers will set up automatic monthly payments through their online banking.

Is there anything else you’d like to add?

- We accept payments for any amounts all year long.

- Your account information is available on our website and is updated nightly.

- Don’t just assume your mortgage company has properly paid your taxes.

To learn more about Porter County Government, visit www.porterco.org.